TRADING JOURNAL

A trading journal is a powerful tool meant to help become a profitable and stronger trader. Essentially, it is a written record of what happened during a trade.

1. TRADING RULES

Risk Management

- Leverage – max 10x, ideal 5x leverage

- Small Losses – the only way to increase account size is to have small losses

- Discipline & System – series of trades (system) over single trade

- Risk/Reward – search trades for min 1:4 RiskReward probabtility

Overtrading

- Relax – Don’t need to trade every day.

- Quality – Reducing trades is the key (only quality trades)

- Master One Strategy – master one trading strategy

- One Trade – Only one / two trades are enough for day trading

- Profits – account size increases by making profits not frequent trading.

Critical

- Time Element– give price time to execute, stay patient

- Market Goal – take your money

- Supply & Demand – put odds of success in your favour (supply/demand)

- Survival & Inventory – you hard earned cash is your inventory, never stockout

- Smart Money – follow smart money and supply/demand zones

Psychological

- Getting Rich Scheme – means repeatable trading proces plotted into months

- Market Has No Feelings – you cannot persuade it by speaking

- Todays market price – has already factored all news and economy

- Do not chase the price – wait once it back to demand zone

Six Types Of Market

- UpQuiet – price is moving up, but the day-to-day activity of the market is not active.

- UpVolatile – price is moving up, and the day-to-day activity of the market is fairly active.

- SidewaysQuiet – price moves very little over time and the market also shows little day-to-day movement.

- SidewaysVolatile – price moves very little over time, but the market shows a lot of day-to-day movement.

- DownQuiet – the price is going down, and the market shows little day-to-day movement.

- DownVolatile – one of the six types of markets in which the price is going down, but the market shows a lot of up and down movement, as opposed to a down-quiet market.

2. TRADING PLAN

S&P500

- Profit Target – 10% daily

- Smart Money – bots and algorithms are targeting liquidations.

- Amount of trades – do not overtrade, this is business, not a game

- Supply/Demand – buy only at demand zone and sell at supply

- Breakouts – do not trade breakouts

- Intraday Market Conditions – is market rising, falling, or going sideways?

- Position Size – never go in one position, split into 4x, pyramid it once you are in profit and quit immediately when you are stopped out.

3. CHARTS

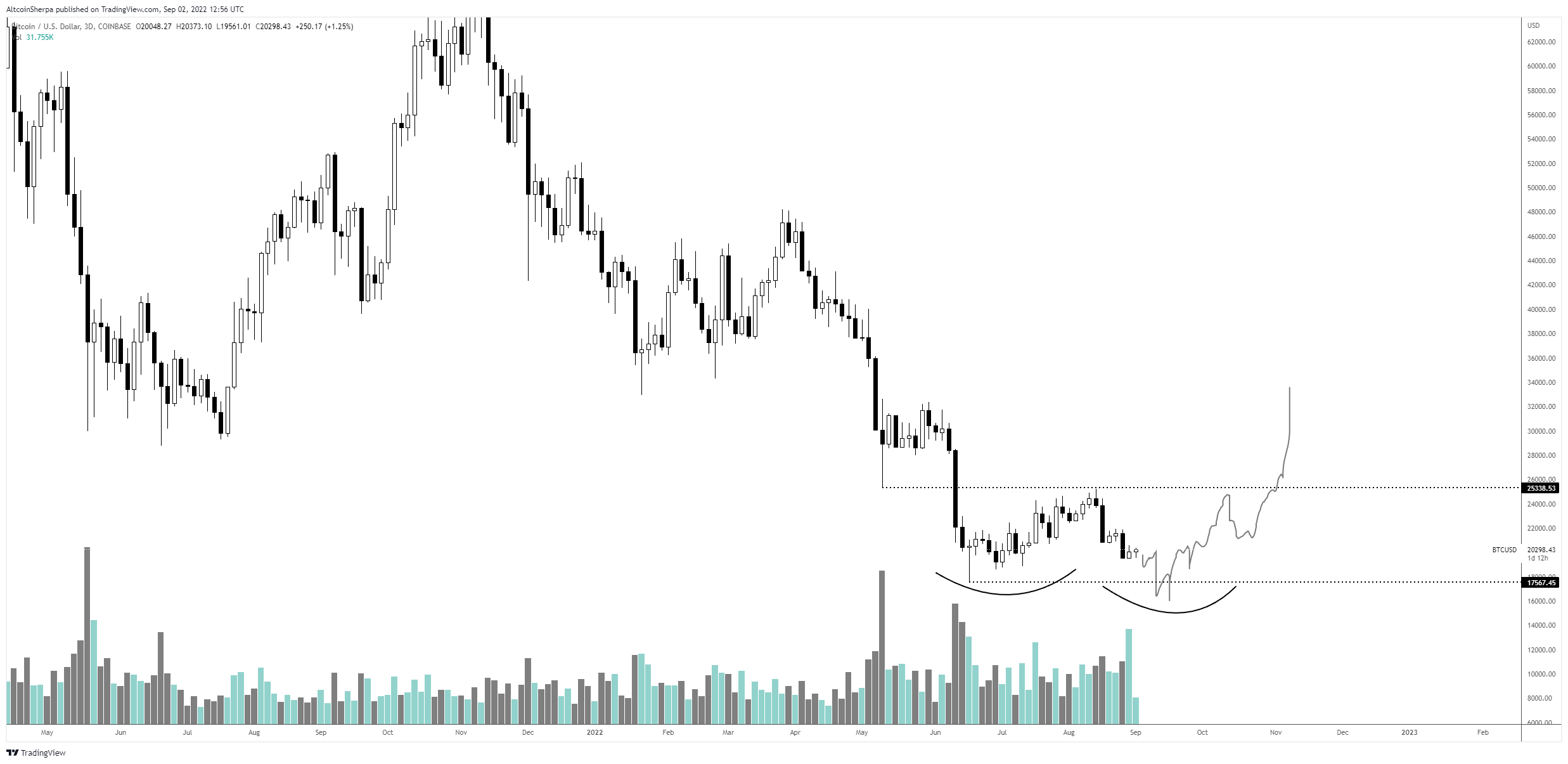

05/11/2022 – 11/10/2022