START – Trading Psychology

Stop Thinking Like an Average Trader

- Trading is as much a profession as any other.

- Trading is as much a human performance activity as is any athletic endeavor.

- Objectives are important and you achieve them through position sizing strategies.

- Trading is driven by probabilities and risk-to-reward ratios under specific market conditions.

Reprogramming Yourself

You don’t trade the markets, you trade your beliefs about the markets; and if your beliefs are not useful, you’re in big trouble as a trader. The average trader will struggle to accept the notion that you trade your beliefs about the markets, but it is a critical change of perception. This change is what allows you to begin reprogramming yourself. Everyone has beliefs about the market, including non-traders and non-investors, and if you really examine them, you’ll find that most are not that useful.

- A perfectionist part that won ’t let you do anything until you’re sure things are perfect. This part’s definition of perfect might be making money on every trade. It is not a very useful part to have, and yet many people do have a part like this.

- The risk manager who cannot stand to lose money and who is always afraid to do anything that might cause him to lose money.

- The researcher who is always trying something new. This can be useful to a trader, but it can also be distracting.

- The excitement-seeking part that wants to do things in the market that provide you with big thrills. Good trading is usually boring, so a part like this is probably not helpful at all.

- You could have a part like your dad that criticizes you whenever you do anything wrong. If that sort of dad is in there, you probably feel put down and often criticize yourself in order to protect yourself from your dad ’s criticism.

- Perhaps your mom is in there, and she ’s always saying, “Please get a real job.”

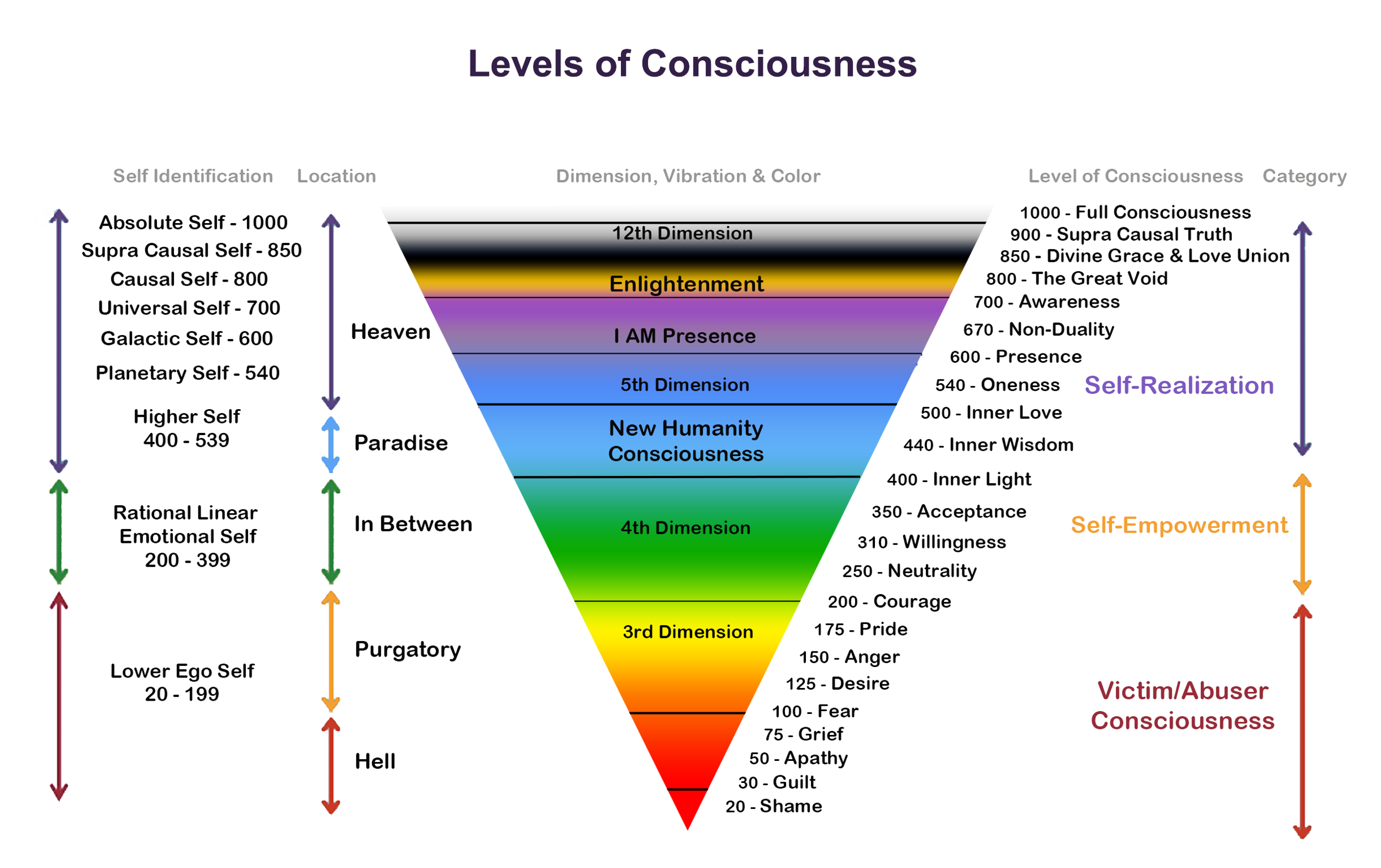

Increase consciousness

Raising your level of consciousness, even to a small degree, can have a profound effect on you as a trader. If you are trading at a low level of consciousness, you are probably trading out of fear, greed, or desperation. Can you imagine what effect it might have your trading if you were to trade from a level of acceptance or peacefulness? The difference would be enormous. Each of these new rules has a big insight behind it.

#1. Trading is as much a profession as any other:

If trading is a profession, you realize that to do it well, you must learn the profession well. You will expect to devote significant time working on your skills as a trader if you hope to be successful at it. In turn, this places your focus not on the markets, but on you and the decisions you make. This naturally leads you to comprehend what comes next…

#2. Trading reflects human performance just as much as any top athletic endeavor:

Because trading reflects human performance just as much as any top athletic endeavor, it follows that you are responsible for the results you get.

#3. You must define your individual investing objectives:

The third new rule, that objectives are important, implies that you have to think through what your objectives are in terms of performance expectations and risk tolerance (meaning how much you could allow yourself to lose). This is a big insight because the average trader doesn’t even think about their objectives, let alone to articulate them. Instead, they simply assume that it is good enough just want to make a lot of money. It isn’t good enough. Without articulating your objectives, you will have no idea how to make a lot of money trading.

Once you have articulated your objectives, you can achieve them through position sizing™ strategies. This is the KEY insight that is purely unknown to the average trader. In fact, most traders simply don’t believe this is true, or that if it is true, it is barely relevant. You can control the results you get by controlling the position size you employ on each trade. This is a very powerful concept and the foundation of your success as a trader.

It is possible to measure the quality of your system, and that will tells you how easy it will be to use position sizing strategies to achieve your objectives. This is a more advanced concept covered in later lessons.

#4. Trading and investing consists of the study of probability and reward-to-risk ratios under specific market conditions:

Because investing is all about probability and so forth, you can use statistics to predict some boundaries for your performance. While you cannot predict the future, you can get a good idea of what your performance will be through statistics and proper sampling under the different possible market conditions. As you begin to understand this, you’ll be amazed at the changes that occur in your thinking. These changes will help you refine your expectations and objectives and immediately begin helping you become better than the average trader. The four primary rules above have many parts and other rules that are required to implement them.

#5. A Trader should never enter into a position in the market without knowing how to determine when they are wrong and where they should get out of the position:

The fifth new rule is to never enter into a position in the market without knowing when you are wrong and how you should get out. This implies that you will need to have a stop exit at that point. The key insight that this rule creates is that you can now very concretely quantify your risk in the trade. That is a powerful point of control that the average trader and investor simply never has.

The difference between your entry into a position and your predetermined exit is your initial risk in the trade. This initial risk is what we will call 1R for short. R for risk, and 1 meaning a multiple of 1. This simple concept is a major building block for helping you unlock more powerful insights into your trading.

#6. Never enter a position in the market unless you have a potential reward that is at least three times the size of your initial risk:

If you won’t enter into a position unless you have a potential reward that is at least three times the size of your initial risk, you can quantify the outcome of your trades in the following way: -1R represents a loss and +3R represents your average gain.

Now let’s see what the sixth rules give us. Imagine that your system makes money 40% of the time and it follows these rules. Yes, you lose more often than you win, but remember that when you win your goal is to make +3R. In ten trades you might lose six times at an average loss of -1R each time and a total loss of -6R. But you’d also win four times with an average gain of +3R each time. Your total gains would be +12R and your total loss would be -6R. Despite being wrong 60% of the time, the net gain for the ten trades would be +6R. That sounds pretty good, but how can well tell if it is truly a worthwhile performance?

Mental Strategy

Let’s break this strategy down so you can see how it works. Before anything happens, you have a belief in place. A belief that particular trading signal is worth observing and acting on. That belief leads you to go looking for such a signal. When the signal appears, this mental strategy kicks into gear. You visually identify the signal, which triggers a thought that a matching signal has arrived. This thought triggers an emotion, that you feel good about this signal, which in turn triggers an attitude or desire to perform an action such as making a trade. With this mechanism in place, you take the action of making a trade.