START – Stop Losses

Protect your trading account

A stop loss is an order that automatically closes your trade at a specified price. They are used as a fail-safe mechanism to protect your trading capital in the event that the trade does not work out. Stop losses are therefore vital in protecting your trading capital, but there are different types of stop losses and a number of ways to determine where they should go.

Knowing where to place a stop loss order is not always clear. For example, you can use technical analysis to find levels of support and resistance, or you can place a stop loss based on nothing more than the amount of time for which your trade has been open. There is also a difference between a fixed stop loss and a moving stop loss.

Using swing highs and swing lows

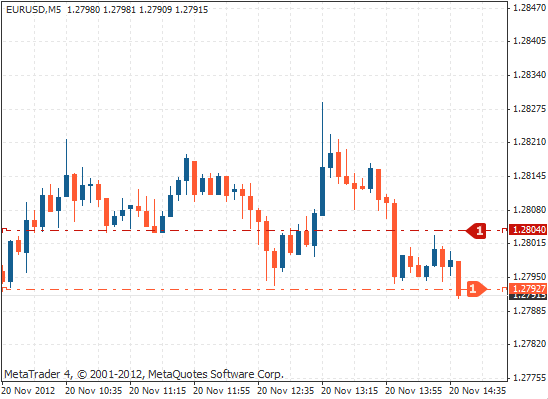

If you enter into a trade, you can use the swing highs and lows to place your stop loss. These are logical places to put stop losses because they are the most recent prices at which the sellers and buyers were willing to sell and buy at respectively. The following chart shows an example of a long trade where the stop loss has been placed under the most recent swing low:

If you enter a short position in a downtrend then you can use the most recent swing high to place your stop loss, as the following chart demonstrates:

Support & resistance

One of the most common methods for determining a stop loss placement is by using support and resistance. Support and resistance indicate where buying and selling is likely to take place. In other words, you can see the highest price and the lowest price at which other traders are willing to buy or sell in the current market conditions.

Using trend lines or channels

Another common method to place a stop loss is by using a trend line or a channel. Place your stop loss just outside of the channel, above or below the trend line. Once a channel has been established, it is unlikely the price will move outside, which means that you can use either the upper or lower boundaries to place your stop loss. If the price does break through the channel, then it is likely that the channel is breaking down and no longer valid.

One frequently used option to set the stop loss is outside of the upper or lower boundary of the channel. The chart below demonstrates that after a channel had been established, one option is to place the stop loss just below the lower boundary:

Using moving averages

Moving average can also be used as support or resistance, in which case the best place to set a stop loss is on the other side of the moving average, much the same way that horizontal support and resistance or channels are used. In the following chart, you can see an example of a long entry where the stop loss has been placed underneath the moving average:

Trailing stops

Trailing stops are stop loss orders that follow a trade as it moves in favour of either your long or short position. Some trading platforms have an option to set a trailing stop after the trade has gone a certain number of pips into profit. As the price moves in favour of the trade, a trailing stop loss will initialise and move in the same direction as the trade. This will reduce the risk as the trade goes on and eventually lock in profit.

For example, if you have entered into a buy trade as the price found support at the moving average, you can adjust the stop loss under the moving average as the trade develops. The following chart shows how you can adjust your stop loss up in the direction of the trade using a moving average:

How and when you decide to move the stop loss using the moving average is up to the trader. For example you can move the stop loss up in stages, as in the example above, or you can move your stop loss up each time a new candle appears and the moving average develops.

Time-based stop losses

A non-technical tool that can be used for placing a stop loss is the time-based method. The concept of this stop loss depends on how much time a trader is willing to hold a trade. A pre-determined amount of time is set and after that time has elapsed, the position is closed.

The reason why traders use a time-based stop loss is that if the markets do not seem to be moving in either direction and neither your stop loss nor the profit target has been hit, after a set period of time you can close down that trade in order to seek a better one for your trading capital. If the market price does not move significantly in either way, there would seem to be no advantage in keeping it open. It is important to note that with trailing stops and time-based stop losses, money management rules still apply and should be used in conjunction with a pre-determined stop loss and profit target.

Guaranteed stop losses

There are some instances where the market price can gap between time periods — that is the opening price is different from the closing price. This can be common when the market closes and then opens the next day or after the weekend.

If you left your position open in the market during these closed times, there is a possibility that the price can move due to an event and “jump” over your stop loss. This produces a considerable risk to traders that leave open positions in overnight or over the weekend.

Although rare, some brokers will offer a guaranteed stop loss, which can protect you in instances where the market gaps over your stop loss. You may need to pay a premium on the spread to keep the position open over the market close, as well as meet the higher margin levels your broker would introduce.

Trailing stop loss orders

A trailing stop loss order is similar to a standard stop loss, but in this case the position of the stop loss is also moved as the trade progresses. It allows trader to limit the amount of money you could lose if a trade moves against you, but also helps you gradually lock in profit as a trade moves in your favour.

It allows you to limit the amount of money you could lose if a trade moves against you. It can also help you gradually lock in profit as a trade moves in your favour. In theory, the market could move infinitely in the direction of your trade, giving you the potential to make a huge profit with a strictly limited risk. Trailing stop losses are most effective in trending markets, where prices are moving steadily in one direction.

Automatic trailing stop loss

An automatic trailing stop loss automatically adjusts its position as the price of an asset moves in your favor. A benefit of a trailing stop is that it enables you to walk away from an open trade, leaving the automatic trailing stop loss to manage it for you.

For example, you could enter the market with a long, or buy, position and set a trailing stop loss 30 pips below your entry price. This means that if the price drops 30 pips below your starting point, the asset will be sold, the trade will be closed and your loss has been limited to 30 pips.

If the trade goes in your favour, for every pip that the price rises by, your stop loss will automatically move one pip higher too, helping you limit the loss and eventually lock in profit as the trade progresses.

Note that a trailing stop only moves in the direction of your trade. If the price moves against your trade, the trailing stop stays still. The image below shows an example of how the entry point and the subsequent movement of the stop loss positions could appear on a chart:

As shown above, the stop loss remains 30 pips away from the current price throughout the trade. This means that if the market continues to rise, the trade will carry on locking in profit until the price eventually reverses or you exit the trade.

Note that in the chart above, the stop loss would be continually moving upwards every pip as the price moves up every pip. We have just shown you two points where the stop loss would be behind the price to demonstrate that the stop loss moves.

Changing the stop loss order settings

You can change the settings for automatic trailing stop losses – for example how far above or below your entry point you want to place them and how often they will move behind the price – according to your preferences.

For example, you may want to set the trailing stop loss behind the entry by 10 pips and then only get the stop loss to move when the price goes in your favour by 5 pips, in which case the stop loss would then move up at this point to 5 pips behind the entry.

There are also computer programs that can use other methods of automatically trailing a stop loss. For example, MetaTrader 4 allows you to program robots that would trail your stop behind a moving average.

Manual trailing stop loss

Using the Parabolic SAR

One of the most popular technical indicators that traders use to position their manual trailing stop losses is the parabolic SAR indicator. This indicator helps you determine when the price of an asset will change direction or reverse its trend.

The idea is to adjust the stop loss each time the SAR moves closer to the entry price until eventually profit is locked in. The trade is closed when the price eventually reverses. This means that in a long trade, the stop loss is always just below the most recent SAR as the price moves up in favour of the trade. The image below demonstrates how this looks on a chart as the price moves in the favour of a long trade:

Note that in the chart above, you would move the stop loss each time a SAR point appears, we have shown you a few select examples as the trade moves up to show you how the stop loss would move under the SAR.

Swing highs and lows for stop losses

Indicators are a good way to start using trailing stops. However, once you gain more experience, you can use price action. One of the most common ways to manage a trailing stop loss is to use the most recent swing lows or highs. The key feature of this is that the stop loss is not a fixed amount away from the current price, but rather based on the price levels. The chart below shows how a trader uses the most recent swing highs to place stop losses in a short trade:

Trailing stop losses in ranging markets