TRADING JOURNAL

A trading journal is a powerful tool meant to help become a profitable and stronger trader. Essentially, it is a written record of what happened during a trade.

1. Follow THE rules

- Take only high quality trades (Ratio 1:3, be patient)

- Follow Smart Money and Supply/Demand zones

- Buy only at resistance / sell at resistance

- After three losses, stop trading

2. AVOID mistakes

- Do not chase the price

- Stay patient (wait for pullbacks)

- Max 10 trades a day

- Max loss a day 30 USD

- You are Manager of your trade and Market is your boss

22/03/2022

Comments

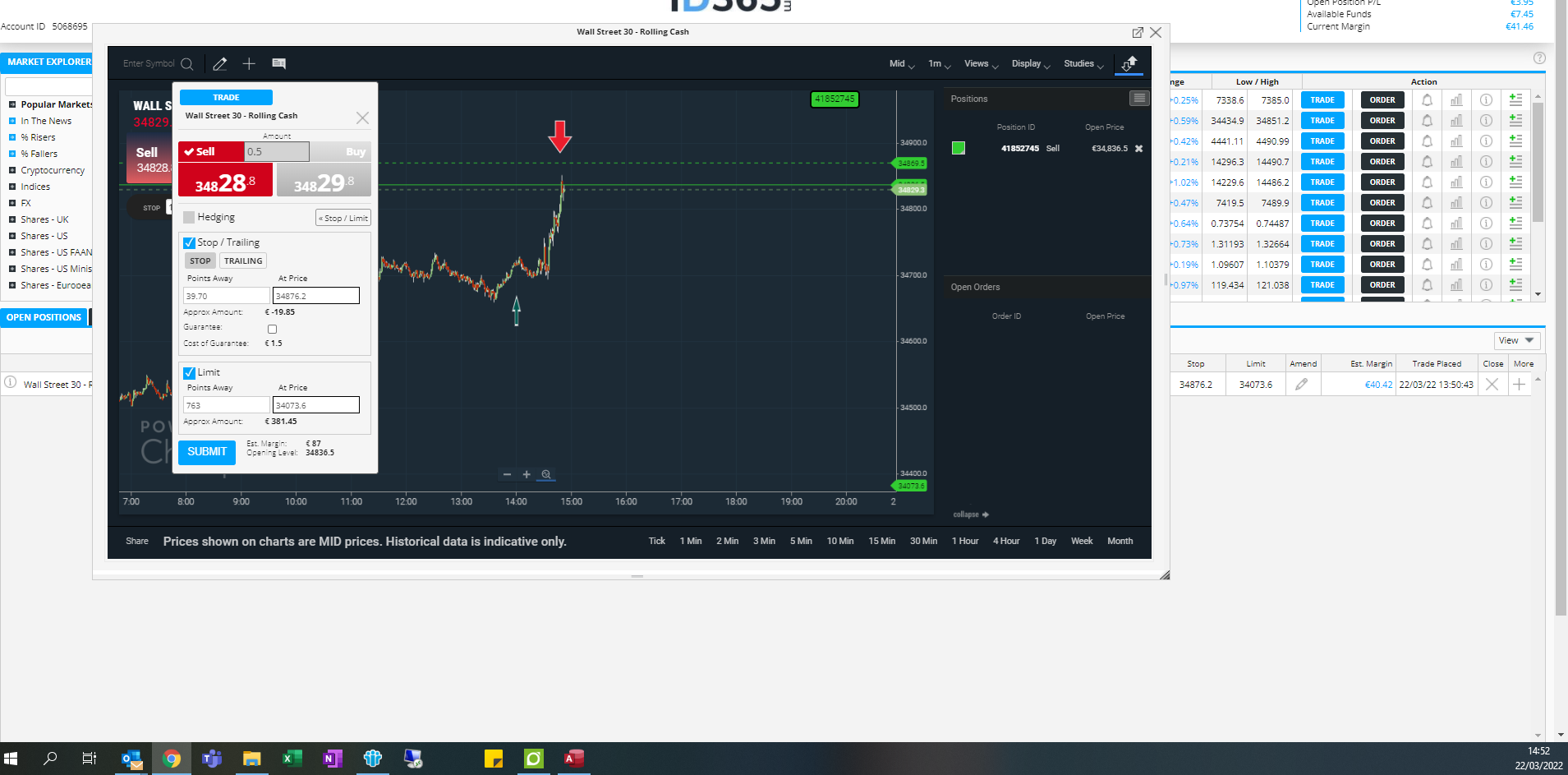

- I took this trade assuming it will go down but it went only higher. In the meantime i have adjusted stop loss from 22 down to 10 so my loss was 7 USD only and stock went much higher. I should not take this scalp short, it did not make sense. I should be waiting lot more instead and wait for perfect entry like i did a bit later. I used wrong stop loss, only 12 points vs 55 points, if i would use stop loss 55 points 22 USD then i would win this trade. I took another quick scalp 30s after first loss and too back 2.50 USD 🙂 so much!

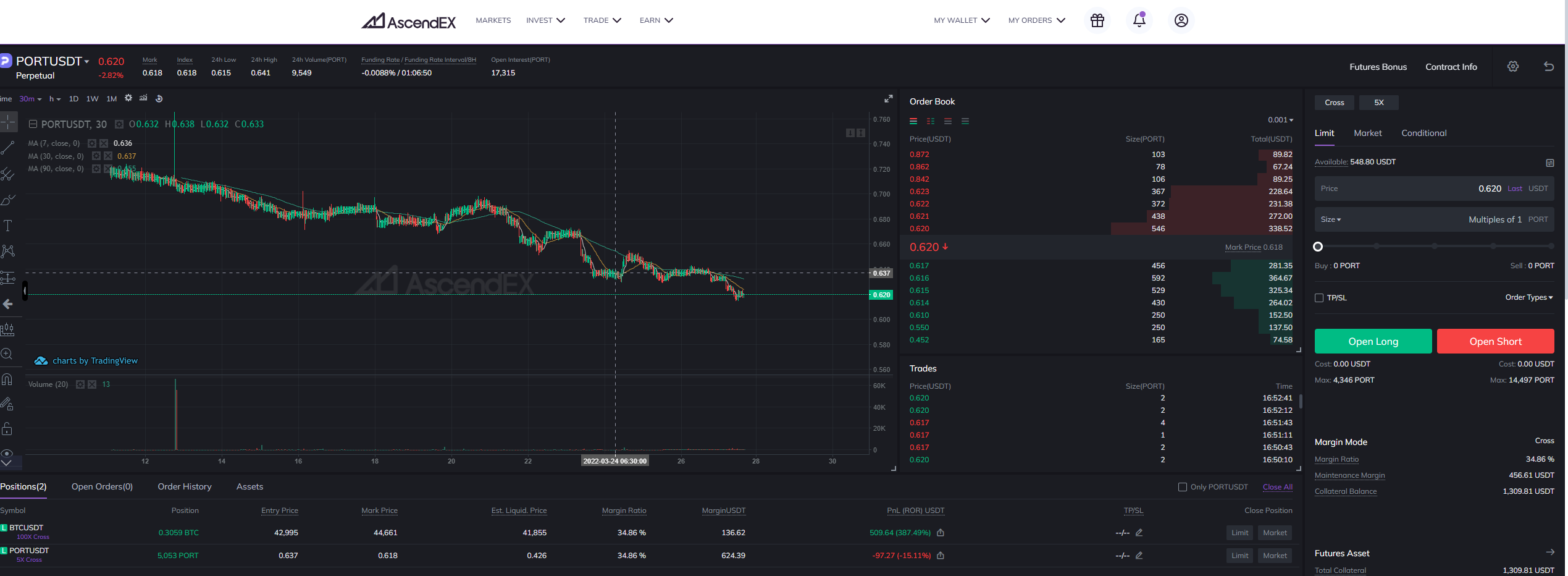

24/03/2022

Comments

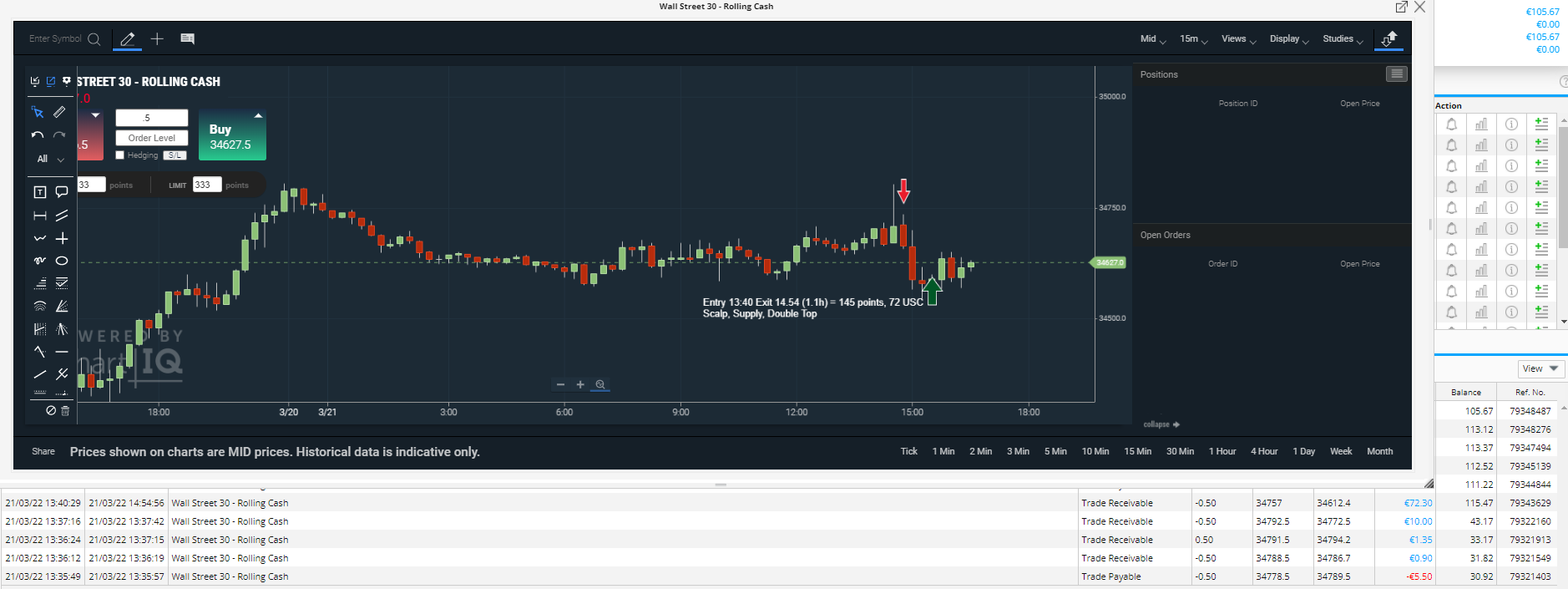

- US30 first trade was a LOSS trade because my stop loss was hit, however as per below indication it end up on my target. To avoid loss i would have to have stop loss of 120 points! (60 USD for 0.5 and 120 USD for 1 lot). To win this trade 2:1 i with one LOT i need 120 USD stop loss and then rewards of 240 USD.

- US30 one trade was a WIN, high quality entry for breakout down, entry at 5/5 quality but then wrongly managed. I have closed trade in the first pullback. This was not that bad but afterwards i tried to re-enter and did it wrong so i lost gains for about 30%. Afterwards i did not manage to enter at all so i lost farther potential gains of 250 points – 150 USD. Finally i can see that entry exit during first pullback is causing also farther losses due to miss opportunity.

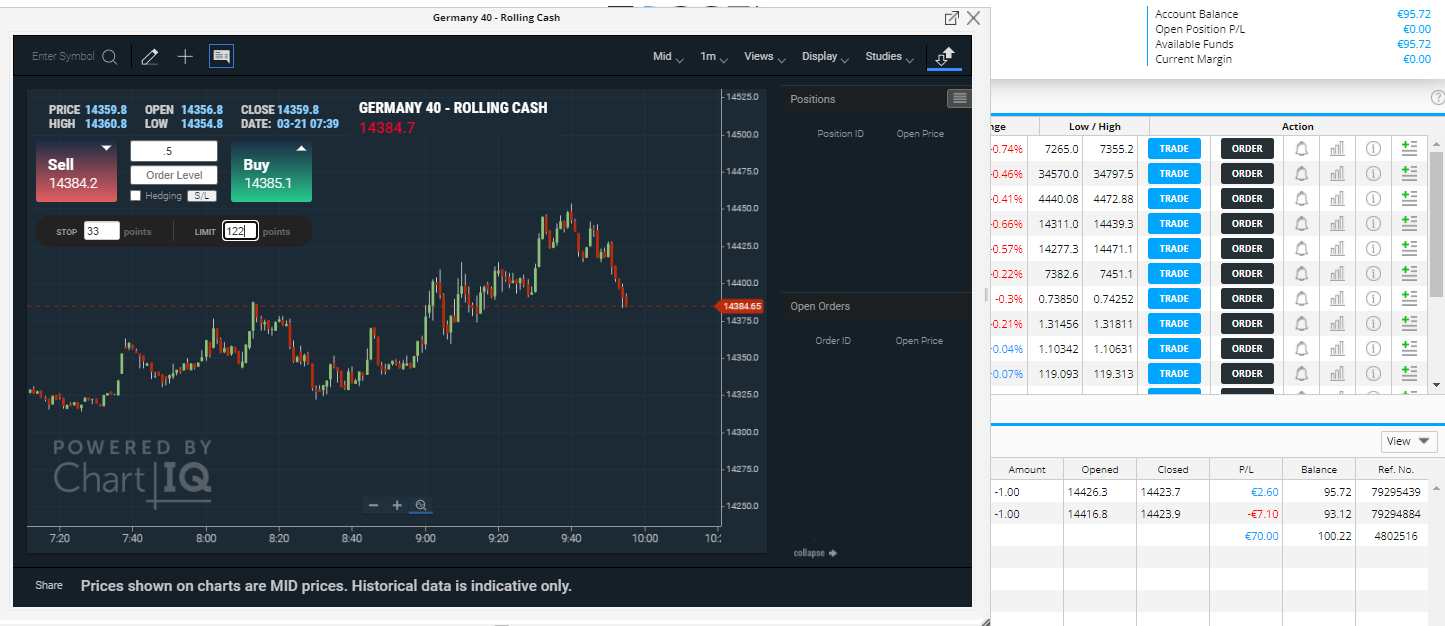

- Germany40 – i took 2 won trades with very stop loss and high profit target of 6:1. Crucial was to enter at very good level like a sniper!

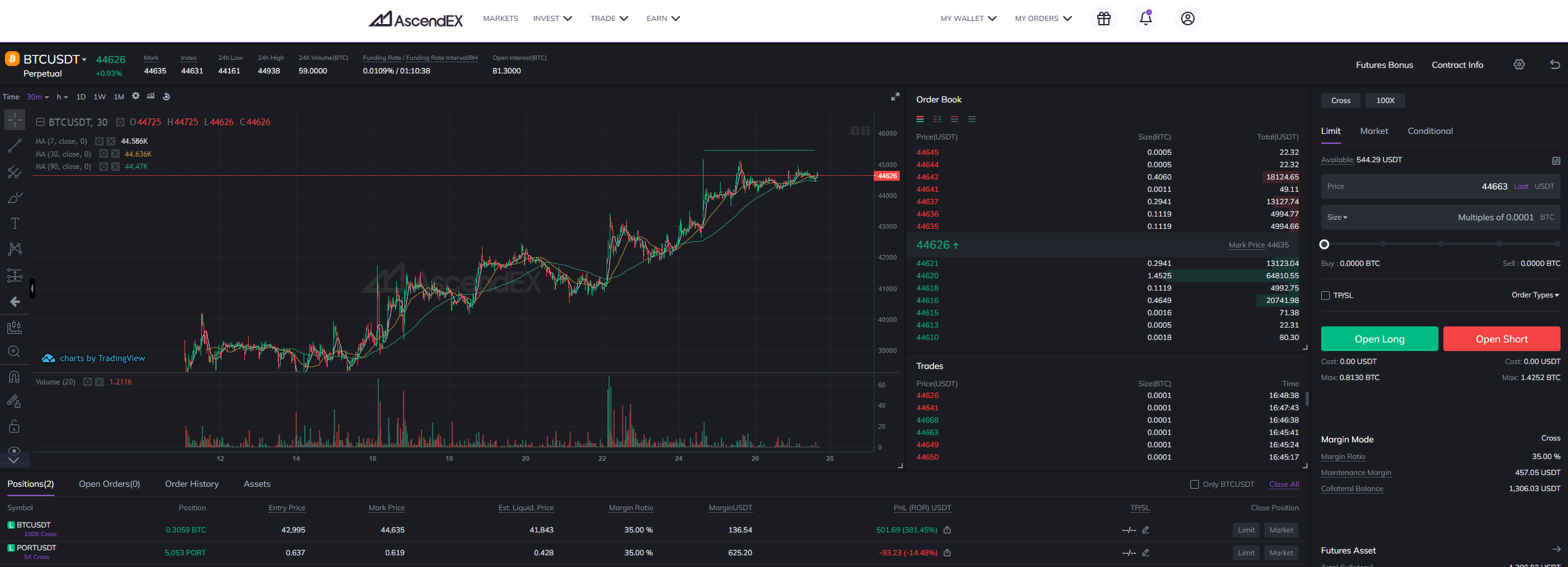

- Bitcoin – i took two trades which are still open and have unrealized PNL of total ~2.500 USD. Target – all time high, next few months, plan is to leave them open. These two trades were in a loss for a while but i kept them running. Ultimate reason why is because i believe we will have another bull run within 2022. If it happens why i should close this positions until achieve targets? Target is around 80-120.000 USD which will give me profit ~40-80.000 USD. If this will happen then i will recover all time losses and put me in green significantly giving money for trade learning next 12 months.

4. Weekly summary

- I took a lot of trades in td365 for US30, Germany40 and Crude Oil

- I have won few trades with very accurate win-loss ratio and these were high quality trades, in total ~3-5

- These trades led to increase my account size almost immediately after trade and led no more than 2-3h afterwards to hit profit

- I took 30-50x entries a day which stop loss of only 10-15 points which led to gradual account drop.

- Such small stop loss if way too low for these markets, appropriate stop loss are 125 points for US30, around 55 points for Germany40

- For crude oil you cannot rely on stop loss, you need to understand trend of the market. All week long market was increasing price and i won few quick trades. Afterwards the only thing to do with this market was to add to winning trending up positions or take profits, nothing more.

PROCESS

It was a loss week in both process and finance terms. I did not respect my high quality set ups, instead placed 200+ super tiny entries with stop loss of 10 points which means nothing for those markets. This was all about TD365 trades. I do not have valid strategy and cannot achieve any kind of profitability and process. In terms of crypto trading it seems to be for me much easier because of knowing lot more about market itself and all details.

MONEY

I have lost -180 USD this week trading US30, Germany40 and CrudeOil which gives cumulative loss of -5.300 USD. On crypto i have two open positions with total gain of 2.500 which will give me in total week on a plus but all time results still negative into -2.700 USD.